Owners of Mortgage Businesses

Quick Question!

You have £50,000 to invest into a mortgage business, with a 5-year return

You have two options:

MORTGAGE COMPANY A: Actively adopting AI and automation

MORTGAGE COMPANY B: Currently ignoring AI and automation

Which business would you choose?

Annmarie Baylan

August 2024

Obvious answer isn't it?

I asked a straightforward question to drive home an important point. So, why are businesses still hesitant to adopt AI and automation, despite the availability of affordable, tailored solutions? The answer is simple: many owners don’t know where to start or mistakenly believe it’s too expensive. That’s exactly why I wrote this article, to show just how easy and cost-effective it is to integrate customised AI and automation into your business. This isn’t just about keeping up; it’s about transforming your company into the kind of business you'd want to invest in while significantly boosting your bottom line.

How much will it cost? Nothing, it should make you money!

Your focus should be clear: Boosting your bottom line. It’s not about flashy tech or expensive marketing; it's about an accountable approach that drives profit and improves cash flow. Your AI partner should be just as committed to your success as you are, with elements of their compensation tied to outcomes like increased revenue.

It Should Pay for Itself: Just one additional mortgage a month directly resulting from AI and automation services, should easily cover the monthly costs, depending on your fees. Frankly, I’d be surprised if any reputable AI and automation service provider couldn’t far exceed this, making the investment not just worthwhile but highly profitable.

Whether you’re purchasing leads or receiving them through referrals, focusing AI and automation on boosting lead-to-completion conversion rates and addressing gaps in your sales process will lead to noticeable increases in income swiftly.

Improving cashflow: Speeding up completions naturally improves cash flow. AI can help eliminate bottlenecks, getting cases processed more quickly and enhancing your cash flow.

"I just don't have time to look at this" is a concern I hear often. Many business owners are so caught up in day-to-day operations that they hesitate to adopt AI and automation, even though these tools could be the key to alleviating that very stress. It’s ironic, really. However, a quick consultation with the right partner can change this. An AI expert with a deep understanding of the mortgage industry can quickly pinpoint where AI and automation will make the biggest impact with minimal disruption to your schedule. This allows you to stay focused on what you do best while reaping the benefits of enhanced efficiency.

"Many businesses lose valuable leads and remortgage business due to inconsistent follow-ups, most owners I speak with are well aware of their 'leaky bucket' problem. AI and automation offer a powerful remedy to this ongoing issue. However, misconceptions about cost, along with time pressures and a lack of understanding of the available solutions, often hold business owners back. By shifting their mindset and embracing these innovative, mortgage-specific improvements, businesses can rapidly unlock substantial growth opportunities."

Annmarie Baylan, Go Automation

So, where do you start?

Your chosen AI partner should help you quickly identify the areas to focus on first.

The ideas below are examples, partner with an expert who can tailor a strategy to overcome your specific challenges. They should analyse lead wastage and bottlenecks, then collaborate with you to set and prioritise objectives.

Focus first on goals that boost lead-to-completion conversions, quickly turning your AI investment into a profit centre.

Out of Hours Lead Management: This is nearly always number 1 for me! Imagine this; your team clocks out at 6 PM, your AI system carries on qualifying and converting leads until 8 PM . The prospect responds later in the evening, say at 10 PM, your AI is ready to answer their questions and qualify them 24/7. By the time your team starts the next day, they’ll come into a list of leads that have met your qualifying criteria and requested a call.Those leads that don’t meet your criteria have been automatically referred to your agreed partners or parked. This ensures your team focus only on the high-potential opportunities , which significantly boosts your lead-to-conversion rate.

Speed to Lead Management: Research shows responding to a lead within the first 5 minutes increases the likelihood of conversion by 100x. However, maintaining this rapid response time consistently can be challenging. With AI, you can ensure any leads not engaged by your team within the 5 minute target are automatically followed up within 5 minutes. This guarantees timely engagement, qualification, and the scheduling of a preferred time slot, ensuring a seamless and consistent response process within the 5 minute target.

Database Reactivation: Every business I know has data they have not managed to contact, its a common problem, as your team may focus on the lower hanging fruit that arrives into the business each day. Let the AI work any dead/no contact data currently in your database, it will find mortgages out of that data without a doubt, what have you got to lose, the data is sat there doing nothing. However, going forward your AI system will ensure you don't accumulate data that has not been thoroughly worked.

AI-Driven Product Expiry Date Appointment System: Don’t rely on basic systems that simply remind advisors of upcoming expiry dates, such methods risk missing valuable remortgage opportunities. A sophisticated AI system goes further by proactively contacting customers 7 months before their mortgage expires, aiming to book appointments directly into advisors' calendars. If appointments aren’t secured, the AI continues to follow up at 6, 5 months, 4 months, and beyond, increasing urgency with each attempt. Its imperative that your AI partner implements an automated appointment reminder system that maximises appointment show up rates and follows up any no shows. The goal of this system is to maximise every ounce of repeat business potential and ensure no opportunity falls through the cracks. Comprehensive reporting offers full visibility into your remortgage pipeline, tracking each opportunity from "not yet due" to initial outreach, all the way through submission and completion.

Multi-Channel Communication: AI effortlessly handles a range of communication channels, including text and voice interactions, missed calls, live chat on your website, and automated responses on social media platforms like Facebook and Instagram. The AI prompts should be customised to match your specific business objectives, ensuring that every customer interaction is both relevant and effective. This holistic approach streamlines and enhances communication across all platforms. Unlike existing website live chat services that charge per interaction, some AI system can eliminate cost per interaction costs.

Customer Information: Most people don't want to spend time on the phone giving you the information you need to source their mortgage. Customer-friendly forms that map to your CRM, reducing manual data entry and speeding up processes are managed and delivered by the AI based on certain triggers, including automatic follow up on lead arriving in your CRM.

This gains enough information and initial employment documents that enable your Team to begin sourcing. Clearly most companies want the advise to include phone calls or face to face meetings, however, maybe consider letting the AI and automation, do the initial leg work and fit in with customer preferences where applicable.

Customer Payments: Collect fee payments by using QR codes or links in emails and texts, triggered by automation at key stages, for seamless transactions.

AI Driven Document Collection,Verification & Credit Checks

Yes, AI can not only automatically request and chase down the correct document sets based on predefined triggers but can also read and verify those documents, including managing e-signatures. A good AI driven document system should be designed to:

In today's fast-paced financial environment, having an effective AI document management system is essential for streamlining processes and enhancing productivity. Here are key features that define a robust AI driven solution:

1. Customised Document Request

A good AI document management system should offer fully customised solutions that cater specifically to the unique needs of your business. It should facilitate a two-stage collection process for both sourcing and application, ensuring that the workflow aligns with your operational requirements.

2. AI Driven Streamlined Document Requests

Look for a system that simplifies document requests by automatically utilising relevant factors, such as employment and mortgage type to request the required documents. A one-click process can greatly reduce the time spent on manual requests, enhancing overall efficiency.

4. Customer Portal for Enhanced Communication

A customer area that provides visibility into outstanding requirements is essential. Implementing a traffic light system can help clients easily track their progress. This transparency fosters better communication and keeps clients engaged throughout the process.

5. Progress Monitoring and Follow-Up Reminders

The ability to track progress with customers and send automated chase reminders for outstanding documents is a crucial feature. This ensures that clients stay informed and engaged, improving the overall customer experience.

6. Document Verification and Accuracy Checks

A quality AI document management system should review and verify documents, in order to save advisors a significant amount of time. Clearly it would always be the responsiblity of the advisor to verify the documents.

7. Comprehensive Document Summaries

Effective systems generate detailed document summaries. For example, a payslip summary could include average gross and net pay over the last three months, while a bank statement analysis could categorise spending for budget planner completions by Advisors. Additionally, a red flag report can identify potential issues, such as gambling activity or discrepancies in income on bank statements vs. income documents.

8. AI-Powered Customer Support

An effective system should leverage AI to address customer queries regarding document rejections. For instance, if a customer submits a blurred image of their proof of ID or an outdated bank statement, the AI can automatically communicate the issue, explain why the document is unacceptable, and request the correct version.

9. Clear Reporting for Advisors

Providing advisors or administrators with a clear list of unresolved issues is essential for efficient follow-up and resolution. This transparency helps maintain momentum in the document management process.

10. Final Document Verification and Easy Download Options

Lastly, a robust AI document management system should deliver a fully verified document pack, marked for final review. It should also allow users to effortlessly download selected documents into a convenient, easy-to-upload zip file for seamless transfer to compliance systems.

By incorporating these features, a mortgage specific customised AI document management system can significantly enhance operational efficiency, streamline processes, and improve the overall experience for both advisors and clients.

While AI can significantly streamline the document process, it should not be viewed as a replacement for fraud checks. However, by providing an AI fully checked pack, the system allows your team to run those essential checks with far greater efficiency, while saving valuable time.

Contacting Leads: Match customer communication preferences

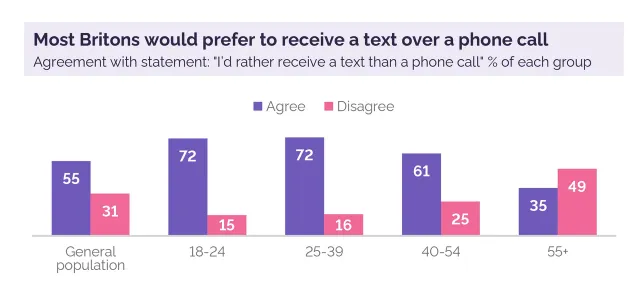

First of all, as you know, the mortgage business is competitive, people often contact multiple companies for proposals. So the sooner you get that conversation started the better. According to YouGov, over 55% of UK adults prefer initial communication via text rather than calls. Even if they’ve made an enquiry, some people find the first call too intrusive and prefer to learn more at a time that suits them, like 10 PM after putting the kids to bed and relaxing in front of the TV! If your competitors aren't doing this, you will engage this customer before they have got out of the starting gates.

This isn’t just one survey; there’s plenty of evidence online supporting this trend. But does that mean you should stop calling leads? Absolutely not, some people still expect and want a call. It’s about meeting your leads' communication preferences and maximising your contact rate. AI-driven text conversations can help you do just that by being available 24/7 to engage with customers via text, maximising your conversions.

Automate your reporting!

Your AI and automation systems should include essential automated reporting. This should include: percentages and average timelines from lead in to: first contact, qualification of lead, AIP, submission and completion. The solution should provide stats for the Company, sales team, advisors in addition to lead sources and introducers where applicable? Knowing all these numbers will help you identify and monitor the areas or team members that need support and improvement.

Should AI replace your sales team?

AI bots, customised to your specific needs, can enhance engagement, reactivate dormant leads, and efficiently manage new enquiries, all without the limitations of fatigue, sick days or attitude.

However, I don't believe AI is here to replace your sales team. Instead, it’s designed to support your high performers by handling the repetitive tasks of filtering out time wasters, unqualified leads, and those who don’t respond. This should leave you with a more motivated high performing team.

AI does mean engagement with your new lead enquiries will be consistent because the AI will be there day in and day out, without distractions. However, you will be able to focus on rewarding your best performers that book the appointments and close the sales and yes maybe removing the ones that are not committed to your business.

It’s crucial to introduce AI to your team thoughtfully, highlighting its benefits while addressing any concerns about job security. Ensure that your AI and automation partner assists in this transition, helping to demonstrate how AI will enhance their work and performance and not replace it.

Integration with your current CRM

A good automation company will provide their own advanced CRM solution that handles their AI and automation processes. However, its not realistic to expect every business which has an established CRM system to switch systems, this is about improving and enhancing process, not throwing the baby out with the bath water.

So it is important to work with a company that can deliver the required services while integrating them into your current CRM.

However, if a business does not have a favoured CRM option, using the system provided by your automation expert should offer a huge amount of added value.

Compliance, GDPR and Security

With the rise of AI companies, it’s essential to ensure your automation partner has a deep understanding of GDPR and security best practices. Many short-lived operations may lack expertise in these critical areas. Be sure to ask about their GDPR compliance: Do they clearly outline subcontractors and systems in their privacy policy? Have they provided you with a data processing agreement for review and signing? Ideally, choose a partner with firsthand experience in FCA compliance and governance, offering an added layer of assurance as this could be essential if you need to prove due diligence about your Partner.

What about disaster recovery? Ask if they have robust backups of AI conversations. If their systems went down, could they restore past conversations? This is vital, as maintaining conversation history is key for continuity and effective AI responses.

Additionally, on going access to these records is essential for handling complaints and ensuring consistent communication.

In summary

Embracing AI and automation can revolutionise mortgage businesses by enhancing efficiency, boosting lead conversion, and streamlining operations.

AI can handle repetitive tasks, nurture leads around the clock and remove bottlenecks in your processes. This should result in increased revenue and improved cashflow from faster lead to completion times.

Automation and AI allows your sales team to focus on high-value activities, boosting morale and conversion rates.

Careful introduction and clear communication about AI’s benefits will help dispel any concerns and highlight how it supports, rather than replaces, your team.

Work closely with an AI partner that has experience in the mortgage business and also thoroughly understands the technical capabilities and solutions.

The right partner will identify key challenges, prioritise solutions, and transform your business into a more efficient and profitable operation with long term solutions.